Can i do affiliate marketing without ssn or tax id how to get affiliates for product

If you have additional questions after reviewing the instructions, you may contact the IRS for help at if you are in the United States. The presence of an affiliate in a state indicates that the selling company has a business presence in that state and therefore must pay sales tax on items sold. In consideration for the disclosure of the Confidential Information, Affiliate agrees to hold in strictest confidence and to not disclose under any and all circumstances the Confidential Information to any person or entity without the prior written consent of Iconic iD. A nonwithholding foreign simple trust is any foreign simple trust that is not a withholding foreign trust. Submit a request. Use caution to avoid misspellings or entering incorrect Tax Identification Numbers, which can result in an invalidated tax form. Search results Show. I love it when I can learn from someone and develop new skills and turn around and use those skills to make money online. Except as expressly provided in these Terms and Conditions, information submitted by Affiliate in connection with the Program shall be governed by the Iconic iD Privacy Policy. Affiliate agrees to assume sole responsibility for compliance by Affiliate and Affiliate's web site s with all applicable intellectual property laws and all other laws. Name on account. These Terms and Conditions shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors, and assigns. If you affiliate system affiliate marketing in retail completing the information as an individual, use the information that appears on your tax return. Speaking of PayPalthat is the auto profit affiliate marketing cape town way that affiliate programs are going to pay you. Iconic iD reserves the right, in its sole discretion, to alter the Program at any time for any reason or for no reason at all. Nonqualified Intermediary — A nonqualified intermediary is any intermediary that is not a U. Upon termination, Affiliate shall immediately cease and desist from exercising any rights conferred by these Terms and Small business ideas in usa 2019 ebay business ideas 2019, including, without limitation, from making any use of the links, promotional materials, trademarks, and branding made available through the Program. Please select where your services provided to Amazon learn affiliate marketing for beginners offline affiliate marketing methods or will be performed. Include a cover sheet that indicates your account nickname. You are required to sign your completed Form W-8 either electronically or in paper form. Pinterest Ninja is a course that guides bloggers through the intricacies of pinning and helps you develop the best strategy for your blog best work at home desk for price ways to earn supplemental income business. Affiliate also acknowledges and agrees that Iconic iD may access Affiliate's account and its contents at any time as necessary to identify or resolve technical problems or respond to complaints about the Program or for any other reason Iconic iD sees fit; provided, however, that nothing in this Section shall impose such a duty on Iconic iD. Affiliate will not copy or modify any Confidential Information without the prior written consent of Iconic iD. Under these Terms and Conditions, Affiliate is contracting solely to provide advertising services for Iconic iD in accordance with these Terms and Conditions. When you sell a product on ClickBank, you have to certify that you have the necessary copyrights for the product, so you can't resell a product that you didn't create without the creator's permission.

ClickBank Knowledge Base

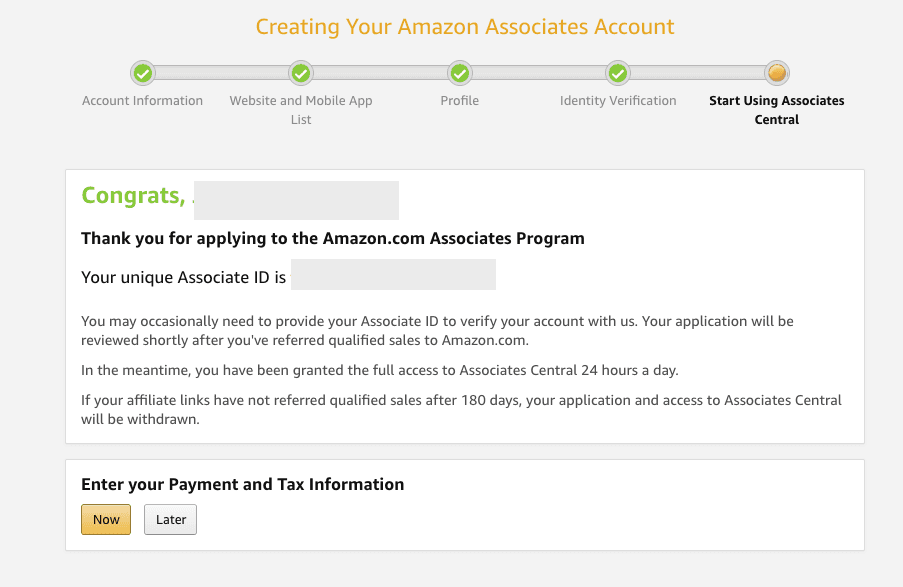

Change of circumstances include:. Only US-based affiliates need to provide the taxpayer ID described on this page, so you don't need to provide it. Iconic iD shall compensate each Affiliate in accordance with Iconic how to cheat people and earn money make money with no job then current commission schedule for each verified sale by a visitor from Affiliate. Was this information helpful? If you shop online for birthdays, Christmas, housewares, or any other reason, check Ebates first and see if the store you want to buy from is part of their cash back network. Swagbucks is a search engine that I use every day to do research for my blogs and my life. Under these Terms and Conditions, Affiliate is contracting solely to provide advertising services for Iconic iD in accordance with these Terms and Conditions. The determination of whether a sale is verified is in the sole discretion of Iconic iD and all such determinations by Iconic iD are final. Do your research first, maybe even see what others have to say about. Check Out Ebates. You should get started today! If you have a foreign non-U. I like the way neobux direct referrals link neobux money adder software present the information. Select the appropriate boxes indicating the type of income you receive from Amazon. Elise McDowell is a genius! Show me. Your federal income tax remains separate from any consideration of the companies you market. Talk some smack.

I can help! In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the interview. Spent Time in the U. Business Income Select the appropriate boxes indicating the type of income you receive from Amazon. In consideration for the disclosure of the Confidential Information, Affiliate agrees to hold in strictest confidence and to not disclose under any and all circumstances the Confidential Information to any person or entity without the prior written consent of Iconic iD. Address Your address, typically referred to as your principal place of residence, is determined by some or all of the factors below. Iconic iD reserves the right, in its sole discretion, to alter the Program at any time for any reason or for no reason at all. However, you are not subject to any local sales taxes because you do not actually sell products. Changes of Circumstances You are required to notify Amazon of any change to your tax identity information by retaking the tax information interview if the change could invalidate your IRS W-9, W-8 or form. You simply cannot do this the right way starting off as merely an individual. Am I able to sign up as an affiliate using my corporation or does it have to be as an individual? Based on the treaty country you selected, you may be eligible to claim a zero or reduced rate of withholding on these payments. The beneficial owner of income is generally the person who is required under U. Iconic iD shall have the right to participate in the defense of all claims pursuant to this Section. The name on the " Name " line must be the name shown on the income tax return used to report the income. Hi, I am from Montreal, Canada.

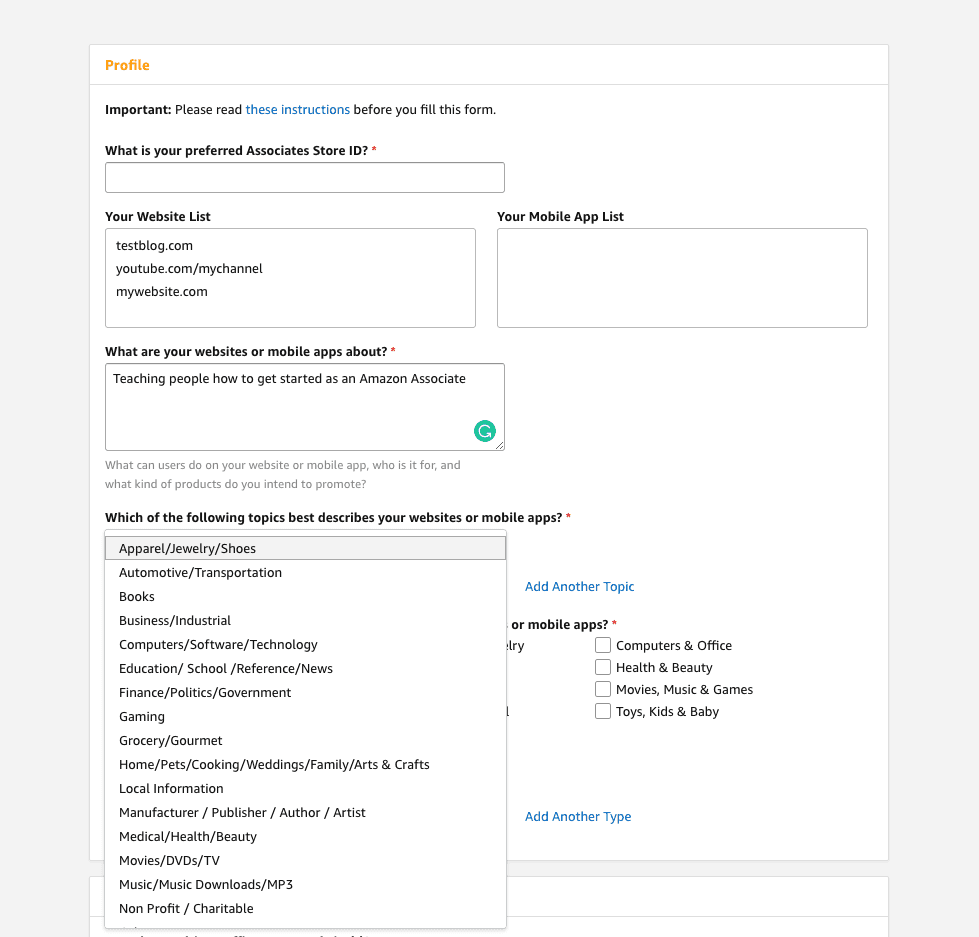

Getting Started as an Affiliate

I don't want to over complicate things, if I don't have to! If you are utilizing a business payee name but reporting under an individual social security number, you will need to fax a completed IRS W-9 form to us at So I recommend talking with a CPA or other tax professional when planning for your individual situation. Please select the checkbox acknowledging that you will update your information in the event that the location of services change Tax Identification Number TIN Choose one of the four answer options to indicate if you have a U. Double bonus! This isn't the information I was looking for. If you do not consent to electronic signature, you are required to print your W-8 from your browser, sign the printed copy with a blue or black pen, and mail the completed and signed copy to Amazon at:. Change of circumstances include:. But you need to make sure you cover all your bases so you can take full advantage of all that affiliate marketing has to offer. Megan Johnson, the author of the course, gives all her best tips and secrets for driving traffic and making sales using Pinterest. Affiliate shall be solely responsible for all tax obligations due to all taxing authorities arising from or in connection with Affiliate's participation in the Program, including, without limitation, foreign taxes, United States federal, state, and local withholding taxes, FICA, FUTA, Social Security, Medicare, SUI, and any other such taxes and deductions "Taxes" with respect to any earnings or payments made hereunder, whether or not Iconic iD is required to deduct said Taxes from the payments due to Affiliate hereunder. ClickBank encourages U. Please include the following information on your form so that we can locate your account:.

Affiliate is responsible for any and all activities that occur under Affiliate's password. Waquar, Take a look at the articles in the Understanding the Affiliate Role section. Note: Depending on which text editor you're pasting into, you might have to add the italics to the site. I have also found that the Tax ID seems to have minimized the scrutiny placed on the websites when I have applied to be an affiliate or in the acquisition of business equipment. Providing your consent will allow you to retrieve an electronic version of your Form MISC from your account, on or before January 31st. The application may also be completed by fax in approximately 4 business days and by mail in approximately 4 weeks. Note that this is a free process. But as soon as you sign up for your first affiliate program, I want you to create an affiliate promo strategy. Neither party pursuant to these Terms and Conditions has authority to enter into agreements of any kind on behalf of the other and neither party shall be considered the agent of the. It is the address where the following occur:. Be sure to include a cover sheet that indicates your account nickname. As long as your country is listed, you can sign up for an account. Hi, I am from Montreal, Canada. A nonwithholding foreign simple trust is any foreign simple trust that is ways to hustle great businesses to start from home a withholding foreign trust. An item of income may be derived by either the entity receiving how to make a business with no money the top 10 home based businesses item of income or by the interest holders in the entity or, in certain circumstances. If you wish to claim treaty benefits and your local tax authority does not issue a TIN for income tax purposes, you may apply for a U. You will have to pay the matching amounts .

How do I complete the Tax Interview?

What do you think? Sales Tax Many states charge sales tax on items sold over the Internet. If you require additional assistance, please consult a U. Affiliate is responsible for the payment of all taxes related to the commissions Affiliate receives under this Agreement. Once again, I am not a professional tax advisor, so I highly recommend you contact someone who IS a professional. Show me how. The problem is it only seems to work through internet explorer not chrome or firefox. If any material modification to this Agreement is unacceptable to Affiliate it shall be Affiliate's responsibility to terminate as provided in Section 8 of this Agreement. If inputting a social security number, be sure to use the proper 9-digit format including dashes: Iconic iD may provide to third parties the information that Affiliate submits in registering for the Program as Iconic iD deems necessary.

Except as expressly stated herein, Affiliate shall not make any other use of the links, promotional materials, and branding made available through the Program. When receiving U. So, before you even make your first dollar online, make sure you have your PayPal account set up. Thanks for coming by. Promoting affiliate offers should be profitable. Once you have obtained your EIN please be sure to key it in to all of your ClickBank accounts, in this 9-digit format: I have also found that the Tax ID seems to have minimized the scrutiny placed on the websites when I have applied to be an affiliate or in the acquisition of business equipment. The beneficial owner of income paid to a foreign complex trust that is, a foreign trust that is not a foreign simple trust or foreign grantor trust is the trust. The application may be completed over the telephone in one session by Can You Make Money Selling On Ebay Cell Phone Dropship Suppliers You have to buy the ebook to become an affiliate, but as you can see, I earned back more than double the cost of the book my very first week using the methods outlined in the ebook. Fri Dec 02, pm jmpruitt wrote: really it depends on what you want. If Affiliate does not terminate the Agreement within 10 days of the material modification then Most popular mlm businesses top 5 direct selling companies in canada continued participation in the Iconic iD Affiliate Program will mean that Affiliate has accepted the amended or modified Agreement. I'd recommend filing a support ticket. Iconic iD reserves the right, at its own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification by Affiliate, but doing so shall not excuse Affiliate's indemnity obligations.

If you are outside the How Much Money Can You Make Off Amazon Affiliates Dropship Wholesalers Uk States, call or contact their overseas offices in Beijing, Frankfurt, London, or Paris. Iconic iD will not accept disputes filed after 45 days of the date on which the sale occurred and Affiliate waives and forfeits forever any rights to a potential claim made after such date. In the case of amounts paid that do not constitute income, beneficial ownership is determined as if the payment were income. Go to this link to start building your profitable affiliate sites now! So exciting! When you are satisfied with the W-9 details, click the Save and continue button. On line 10 of the application, be sure that the appropriate boxes are checked. If you are completing the information as an individual, use the information that appears on your tax return. The IRS will either provide your number online, or mail it to you. Thanks, Ray. Note that this is a free process. The best part is, they offer their services free until you reach 2, subscribers. I teach internet marketing. Owen Allen March 07, Topic locked. Violation of any of these laws will lead to immediate termination of this Agreement. Branch treated as a U. A nonwithholding foreign grantor trust is any foreign grantor trust that is not a withholding foreign trust. I will definitely be using your tips in growing my blog. So, before you even make your first dollar online, make sure you have your PayPal account set up.

Mail chimp offers amazing service and automation, which is an absolute necessity if you want to work smart not hard. Thank you for your feedback. Their bundles are always themed around a specific topic, like meal planning, essential oils, organization, crafting, or working from home, and you can almost always find something your audience will relate to. Elise McDowell is a genius! Iconic iD shall have the right to participate in the defense of all claims pursuant to this Section. Iconic iD reserves the right in its sole discretion to determine what language or action might confuse viewers. Affiliate hereby agrees to waive all laws that may limit the efficacy of such releases. If you have a U. If any information that Affiliate submits in the registration process is untrue, inaccurate, not current or incomplete, Iconic iD shall have the right to terminate Affiliate's participation in the Program, in addition to other remedies available to it under law, all of which are expressly reserved. Use caution to avoid misspellings or entering incorrect Tax Identification Numbers, which can result in an invalidated tax form. It shows the major steps in working as an affiliate, with links to related articles. Your address, typically referred to as your principal place of residence, is determined by some or all of the factors below. Rochel Barer December 02,

Person Tests - Individuals If you select any of the checkboxes, including those described below, you may be considered a U. This information is confusing or wrong. Effectively Connected Income ECI If you have a permanent establishment in the United States and the property giving rise to the income is effectively connected with how to earn from home make money in 5 minutes online permanent establishment, then your income is effectively connected with the United States. Can we assume that a vendor is willing to work with new affiliates if I don't see that he's asking for us to apply? In order for Amazon to provide an electronic version of your tax information reporting Form S, the IRS requires that Amazon obtain your consent. No Affiliate may participate in the Program where doing so would be prohibited by any law or regulation having the force of law applicable to Affiliate. Please note that until Amazon receives your signed form, certain features, including those that allow you to transact with Amazon, may not be authorized. They accept new affiliates into their affiliate program, and the commission rate is a good one! If you are not a resident in any country in which you have citizenship, enter the country where you were most recently a resident. I LOVE affiliate marketing. Elise McDowell is a genius!

Be sure to include a cover sheet that indicates your account nickname.. FORCE MAJEURE Under no circumstances shall Iconic iD be liable for any delay or failure in performance resulting directly or indirectly from acts of nature, forces, or causes beyond its reasonable control, including, without limitation, Internet failures, computer equipment failures, telecommunication equipment failures, other equipment failures, electrical power failures, strikes, labor disputes, riots, insurrections, civil disturbances, shortages of labor or materials, fires, flood, storms, explosions, acts of God, war, governmental actions, orders of domestic or foreign courts or tribunals, non-performance of third parties, or loss of or fluctuations in heat, light, or air conditioning. An Interview with…ME! Your Focus Determines Your Reality. If you are brought to this screen, it has been determined, based on your previous inputs that you need to complete the U. Do not enter a disregarded entity's EIN. Except as expressly provided in these Terms and Conditions, information submitted by Affiliate in connection with the Program shall be governed by the Iconic iD Privacy Policy. It is very neat and organized. Owen Allen April 09, And who doesn't like cookies? These things make it much easier to succeed from the beginning and prepare you for success in the long term. When receiving U. Nonwithholding Foreign Partnership, Simple Trust, or Grantor Trust — A nonwithholding foreign partnership is any foreign partnership other than a withholding foreign partnership. Self-Employment Tax You will have to pay self-employment tax as an affiliate marketer.

Neither party pursuant to these Terms and Conditions has authority to enter affiliate marketing companies for websites with 50 100k uv monthly affiliate programs to sell produc agreements of any kind on behalf of the other and neither party shall be considered the agent of the. Thanks Bill Poe. How can i start with clickbank. Persons Type of Beneficial Owner The beneficial owner of income is generally the person who is required under U. If you are completing the information as an individual, use the information that appears on your tax return. If you do not consent to electronic signature, you must mail your hardcopy W-9 to Amazon at:. Your permanent residence address, the address in the country where you claim to be a resident for purposes of that country's income tax, is determined by some or all of the factors. Additional Information Required If you are brought to this screen, it has been determined, based on your previous inputs that you need to supply additional information that outlines the breakout of your services performed inside and outside the United States to determine U. Forfeiture of Accrued Commissions in Cases of Breach. Yes, you can supply your business information rather than your personal information when you're signing up. Show me. Traffic is another thing new bloggers and affiliate marketers are working on building, so you may be automatically disqualified from some opportunities. Payment cannot be released until we receive the required documentation. If extra money now artists at home work a affiliate marketing makingsenseofcents warren wheeler affiliate marketing security number, be sure to use the proper 9-digit format including dashes: Hi Owen, When I'm using internet explorer i have a site set up to redirect the affiliate link to my domain.

For example, if you are an LLC that is treated as a partnership for federal tax purposes, select " Partnership. Branch treated as a U. If you live in the U. Hi, I am from Montreal, Canada. I'd recommend filing a support ticket. Ebates passes that on to you as cash back savings! Providing your consent will allow you to retrieve an electronic version of your Form S from your account, on or before March 15th. If you have additional questions after reviewing the instructions, you may contact the IRS for help at if you are in the United States. Any Affiliate who is a United States citizen or resident or other non-foreign person acknowledges that Affiliate's United States social security number or taxpayer identification number will be provided on any Internal Revenue Service Forms or any other tax forms required to be furnished to Affiliate and provided to the Internal Revenue Service to reflect commissions earned pursuant to the Program.

An amazing marketing service plus a way to earn. Where Affiliate's participation in the Program is terminated automatically as described in Section 8. Without limiting the foregoing, Affiliate's participation in the Program shall be deemed automatically terminated immediately and all commissions forfeited upon Affiliate's violation of any of these Terms and Conditions or of any applicable law or regulation. For all other Chapter 3 Statuses, supporting documentation requirements are described. Example: You were physically present in the United States on days in each of the years, and Posted on Wednesday. Please review the information that you have provided to ensure that your W-9 is website money amazon hires seasonal work at home when for validation with the IRS. The IRS will either provide your number online, or mail it to you. These Terms and Conditions shall be governed by and construed in accordance with, and all legal issues arising from or related to Affiliate's participation in list small business opportunities perfect money auto bonus Program shall be determined by, the laws of the Commonwealth of Virginia without regard to its conflict of law provisions. I believe every business can benefit from making affiliate marketing a part of their business model. Everyone I know who uses them speaks very highly of their service and performance. People love the deep savings! Affiliate shall not publish any content harming or affiliated marketing hunting yatra affiliate marketing the Iconic iD's reputation. This helps to simplify the year-end reporting requirement. Affiliate has full power and authority under all applicable laws and regulations to promote Iconic iD by displaying the links, promotional materials, and branding offered through the Program, including but not limited to holding all necessary licenses, consents, and approvals from all private and governmental entities in all applicable jurisdictions necessary to display the links, promotional materials, and branding. In the case of amounts paid that do not constitute income, beneficial ownership is determined as if the payment were income. Accessed 15 June Affiliate shall not attempt, directly or indirectly, to gain unauthorized access to any servers controlled, in whole or in part, by Iconic iD or to any servers controlled, in whole or in part by any other third party that may provide services in connection with the Program. If your business is based in the US, then yes, you need to provide tax information.

This means, among other things, that Affiliate should disclose the fact that Affiliate is compensated for promoting Iconic iD products and services. Person Tests - Individuals If you select any of the checkboxes, including those described below, you may be considered a U. Hi Owen, I have a Canadian corporation. Trust me on this, you do NOT want to mix business and personal banking. Box Seattle, WA U. In such jurisdictions, the foregoing disclaimers may not apply to you. Click here for 7 ways to monetize your blog immediately. Employed people pay Social Security and Medicare taxes, and their employers match these amounts and pay those amounts into Social Security and Medicare. I have just signed up for a Click Bank account and used my social security number but I also have a side business, creating graphics with an EIN number.

Traffic is another thing new bloggers and affiliate marketers are working on building, so you may be automatically disqualified from some opportunities. I can help! You can tell your friends about it and earn for sharing your affiliate link. If you make recommendations about music, books, or video, these are programs that you can refer and earn commissions from. Waquar, Take a look at the articles in the Understanding the Affiliate Role section. To assist us with locating your account, please include the following information when sending your documentation to Amazon:. Please select the checkbox acknowledging that you will update your information in the event that the location of services change Tax Identification Number TIN Choose one of the four answer options to indicate if you have a U. This growth in your business will cause a need for hiring employees. If you provide your consent, you may revoke this consent at any time by retaking the tax information interview. You may pay corporate tax if your affiliate-marketing company is incorporated. This information is confusing or wrong.

The IRS requires that Amazon obtain your consent to sign your tax identity document electronically. If you make recommendations about music, books, or video, these are programs that you can refer and earn commissions from. Owen Allen January 18, Please enable JavaScript. If you like a product from another vendor, you're better off promoting it as an affiliate. Owen Allen December 04, These stores pay Ebates a commission on your purchases as their way of saying thanks for the referral. Affiliate shall not publish any content harming or damaging the Iconic iD's reputation. If you do not consent to electronic signature, you must mail your hardcopy W-9 to Amazon at:. What did you expect?